The bank’s anti-money laundering principles

Combating money laundering and the financing of terrorism is an important social obligation that we take very seriously.

Anti-Money Laundering Task Force

In November 2019, Finance Denmark’s Anti-Money Laundering Task Force published 25 recommendations focusing on a joint effort across the financial sector, the authorities and society to combat financial crime. Read more in the summary version of the recommendations here (in Danish).

The bank supports Finance Denmark’s principles of conduct which aim to enhance and unify the commitment to anti-money laundering (AML) and counter-terrorist financing (CTF) by all Danish banks.

Principles of conduct for the prevention of money laundering and terrorism financing

- We commit to combating financial crime in a loyal and responsible manner.

- We recognise that the prevention and combating of money laundering and terrorist financing is not a competition parameter and that collaboration and joint solutions are desirable.

- We will ensure that our management and staff adhere to these six principles and relevant instructions.

The six principles of conduct:

- We always prioritise ethics over profit

- We comply with the spirit and the letter of the law

- We welcome oversight

- We have a targeted corporate culture commitment

- We assume managerial responsibility and ensure that all staff take responsibility for AML/CTF efforts

- We have constructive partnerships with all stakeholders, including the authorities

The bank’s principles for anti-money laundring support the goal of doing everything we can to ensure we are not misused for money-laundering, financing of terrorism, financial crime or other illegal activities.

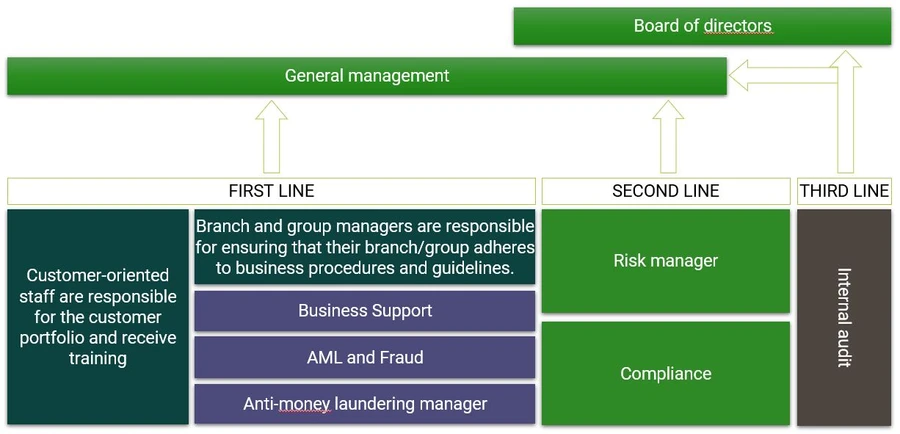

Anti-money laundering, the bank’s organisation

The bank has three lines of defence: The first line of defence is customer-oriented staff and expert functions, the second line of defence is the bank’s compliance and risk functions and the third line of defence is the bank’s internal audit.

Why do we ask our customers for ID/photo identification and where the money comes from when payments etc. are made?

We need to know our customers and understand how you use us as a bank so that we can protect you and us from being misused for money laundering, financing of terrorism or other illegal purposes.

Based on this knowledge, we work continuously to identify unusual or suspicious activity.

We monitor our customers and their transactions to detect unusual or suspicious activity

Our expert function, Anti-money laundering & Operational risk, examines the unusual or suspicious transactions detected automatically by our systems or reported manually.

Our employees notify the Money Laundering Secretariat when the suspicion surrounding a transaction cannot be cleared.

Alarms are raised, for instance, by large or frequent cash transactions and international transfers to or from high-risk countries.

Generally, few reports are made regarding suspicions of terrorist financing, whereas reports on money laundering, in particular suspicions of social security fraud or tax evasion, make up the vast majority.

How do we train our staff?

The bank’s employees regularly complete mandatory training. Targeted information and training programmes on rule changes are also held for selected groups of staff.

Whistleblower protection

The bank has an internal whistleblower scheme under which our staff can use a special, independent, dedicated channel to report violations or potential violations of financial regulations committed by the bank. The bank has established this mandatory scheme in accordance with section 75a of the Danish Financial Business Act.